You should do 60/40 allocation in stocks/bond.You should diversify your portfolio.You should buy this, you should buy that. Okay, those are the things we heard a lot when we start to invest.But what is the mathematically optimal portfolio where you get the best returns while taking the least risk? How to measure how is your […]

Book Summary | Mastering The Master Cycle – Howard Marks

I. Why Study Cycles Risk is the possibility of things not going the way we wanted II. Nature of Cycles Cycles oscillate around a midpoint Cycles will be always be there as every year there will be new market participants that join the market There will be no bust without boom, they are the seeds […]

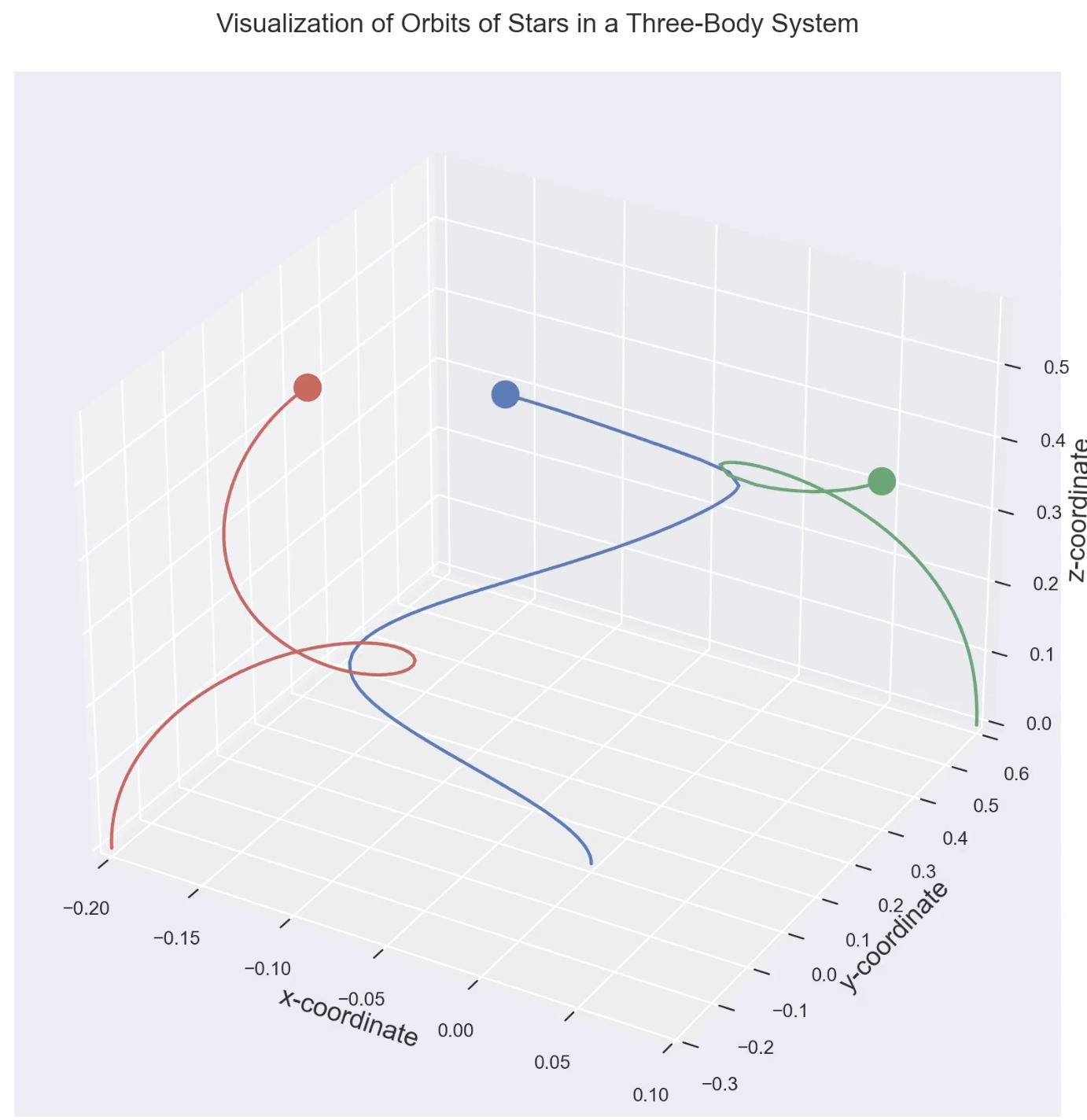

Modelling the Three-Body Problem in less than 200 lines of Python code

I started reading Liu CiXin’s Three Body Problem, and was fascinated by the author’s imagination and scientifically and mathematically rigorous storyline. But what caught my attention is the three body orbits that is unpredictable. Turns out that the three body problem is one of the oldest problem in physics, since Newton. I started digging about […]

Like TradingView’s Volume Profile? Here’s How to Create Your Own using Python

TradingView’s volume profile is one of the indicators that I love the most. You can Determine potential support and resistance levels How many poor souls got stuck at the peak What is the average entry price for most investors But there’s a catch, it’s only available in paid version. Such powerful tools shall not be […]

Intra-day Volatility Patterns in Forex Market

It’s a busy week, and I am running out of ideas to write about,it’s a crazy month too, Worst opening of US equities market Correlation 1 moment happened, diversification didn’t save your ass 1 USD = 20 cents (UST) Anyway, I am doing forex volatility prediction for my master’s degree project,read some literatures out there, […]

Where are the Bulls and Bears Hiding? pt 2. Backtesting Buy Low Sell High Strategy

The war and Covid continued to April 2022, but the world haven’t ended, and markets have rebounded quite significantly, I vividly remember that Alibaba soared 30% in a day in HKSE. This happened over and over again, fear to greed, bear to bull. But anyway, following my previous post link, can we profit from this […]

Where are the Bulls and Bears Hiding? An Analysis of Over 10 Years Timeframe.

In the times of extreme panic, just stand there and do nothing At the time of writing,Russia is invading Ukraine, and this sparked a lot of economic sanctions, rising energy prices, business disruptions, market is speculating FED to raise rates, which the market do not like. Every major market indices are dipping,portfolio turned red, even […]

The One Thing

Question that everyone should ask themselves. First, let us start with a quote. Life is a game in which you are juggling 5 balls. Work, Family, Health,Friends, Integrity. Work is a rubber ball, it rebounces when youdropped it. The others were glass balls, you drop them you lose them. Depending on where you live, most […]

Testing KYY’s Golden Rule using data from year 2011-2021

If you are in the Malaysian investing community,you sure will read a lot about Mr Koon Yew Yin,he is a very respected figure in business and investing world. He is also kind enough to share his insights on investing.He publicly shared his golden rule to investingwhich is My golden rule is the company must report […]

How to Make New Year Resolution that Sticks

Ah, the usual New year new me season is here.So you gonna go to the gym?you gonna save more money?Great, do you have a plan? I know a friend who is like“I wanna buy a house in 5 years”but no actions were made, not even plans.Day after day he went home to play mobile legends […]